An alternative to traditional completion accounts & purchase price adjustments

Doing deals can be an exciting and rewarding process for all parties involved, but in most cases, they require an incredible amount of time, analysis and negotiation to get to the finish line. One of the most contentious issues that continues to plague deals is around working capital – specifically the purchase price adjustments that result from setting working capital targets. If consensus cannot be easily reached, working capital discussions can prolong negotiations, leading to deal fatigue, increased costs and a risk of losing the deal.

To address some of the pain points associated with traditional completion accounts, the use of a Locked Box Mechanism is becoming increasingly prominent, as it can help lead to greater deal transparency, better decisions, and smoother negotiations.

Traditional Completion Accounts

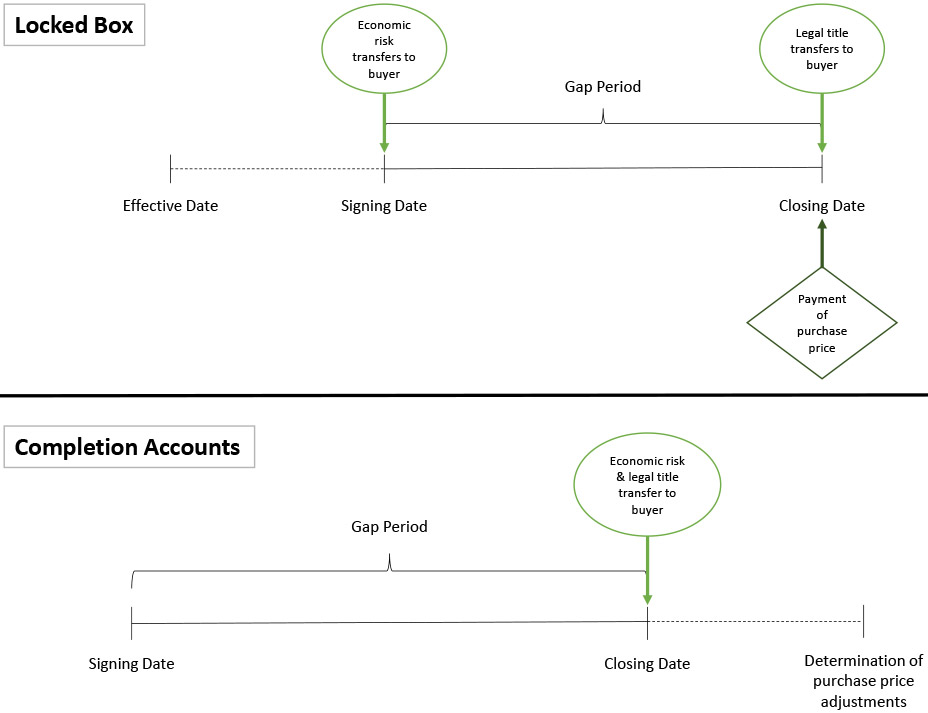

Under a traditional Completion Account approach, the purchase price on closing takes into account an estimated level of working capital as at the Closing Date (actual numbers are not known until the books are closed). The purchase price is then adjusted after closing – generally within 60-90 days – if there is a difference between the actual working capital delivered on closing and the working capital target that was set during negotiations.

The Locked Box

By contrast, under the Locked Box approach, the purchase price is calculated and negotiated with reference to a recent historical balance sheet and determined as at that date. This date is known as the ‘Locked Box Date’ and generally precedes the closing date by 3-4 months. Since the values of all the accounts that make up working capital are known by the parties at the time of the signing of the Share Purchase Agreement (‘SPA’), the agreed-upon price, including all adjustments is fixed and defined in the agreement.

Because there exists no mechanism to adjust the purchase price after closing, this prevents the seller from strategically ‘gaming’ working capital levels in the lead up to closing. Under a Locked Box approach, the economic benefits and risks effectively transfers from the seller to the buyer at the Locked Box date, even though ownership does not transfer until closing.

Primary Differences

Locked Box

- The effective date is situated before the closing date and the purchase price is determined based on the financial statements at the effective date.

- Equity price is fixed.

- Price adjustments for Cash, Debt and Working Capital are agreed-upon prior to signing.

- Price adjustments for Cash, Debt and Working Capital are based on an historical balance sheet (locked box reference accounts).

- There is no adjustment to the purchase price after closin

Completion Accounts

- The effective date is equal to the closing date and the purchase price is determined at closing.

- Enterprise value is fixed, but the equity price is subject to post-closing adjustments.

- Definitions of Cash, Debt and Working Capital are agreed-upon prior to signing.

- Definitions of Cash, Debt and Working Capital are based on completion accounts prepared post close

- The process for preparing, reviewing and agreeing to the final completion accounts is set out in the SPA, and typically occurs within 90 days of close.

Enhancing Deal Value

A Locked Box approach can make it easier for a seller to compare bids in an auction process, as the bidders will be asked to submit a fixed price based on an historical reference balance sheet delivered to them during preliminary due diligence. This allows the seller to create greater competitive tension, more accurately evaluate and compare offers, and ultimately have greater comfort in moving forward with the offer that represents the greatest economic value to them.

Shifting Leverage

Under a traditional Completion Account approach, the buyer typically delivers a final closing balance sheet 2-3 months after closing and is therefore in control of the preparation of that document. This puts the buyer in a strong position to present their view of the estimated value of specific assets such as inventory and accounts receivables which can have a significant impact on the amount of any purchase adjustments. However, with a Locked Box, the seller is in control of preparing the balance sheet and specifying the accounts to be included in the calculation. As a result, after thorough financial due diligence, the buyers and sellers risk is more balanced under the Locked Box approach.

Leakage

A key aspect of a Locked Box Mechanism is that the seller is prohibited from taking value out of the business through to the closing date. This is referred to as Leakage. This leakage could be in the form of dividends, management fees, bonuses, etc.. The parties will need to identify possible sources of leakage, with the seller’s obligations to prevent any leakage usually being supported by indemnification clauses in the SPA:

Permitted Leakage:

is leakage that should not give rise to a purchase price adjustment and may include, for example, amounts payable by the seller to its subsidiaries for services rendered on arm’s-length terms;

Negotiated Leakage:

is leakage that is permitted under the terms of the purchase agreement but gives rise to a purchase price adjustment—including the payment of specific transaction expenses, management fees, bonuses etc.; and

Prohibited Leakage:

comprises all payments to or on behalf of the seller and its subsidiaries which do not fall into the first two categories. The SPA will typically include specific provisions that restrict this type of leakage and gives the buyer recourse against the seller should any of the negotiated terms be violated.

Interest and Profits

Given that the economic interest effectively passes to the buyer from the Locked Box date, cash profits generated by the company will be ‘locked’ inside the box to the benefit of the buyer from that date. At the same time, the seller loses out on the benefit of being able to invest the proceeds of the sale until closing, and as a result, incurs an opportunity cost. To compensate for this, the seller will generally seek compensation in the form of interest payments on the purchase price amount between the Locked Box date and the Closing date.

The Locked Box is Not Always Applicable

There are a number of situations where the locked box approach might not be appropriate:

- The target business is of a seasonal nature and the values in a closing balance sheet will differ greatly from the Locked Box date to closing;

- The target business is highly integrated into the operations of the sellers’ other business units;

- There is a long period of time between the reference balance sheet and closing;

- High-growth companies where the cash accumulation isn’t appropriately offset by interest payments.

The Key to a Successful Deal

The Locked Box Mechanism is prevalent in European M&A but is still nascent in North America. In certain circumstances it can be a useful, value added approach to getting a deal done. It can provide both parties price certainty, increase control of the process for the seller, and eliminate the need for messy purchase price adjustments after close. Although a Locked Box is not appropriate in all circumstances, when it is used appropriately, it’s a mechanism that can save both parties lots of time and money and can help to ensure the deal gets done.

References:

Australia: M&A Purchase Price Calculations – the Locked Box Mechanism – www.mondaq.com

Purchase Price Adjustment Mechanisms in M&A Transactions – The Locked Box Mechanism – www.winston.com